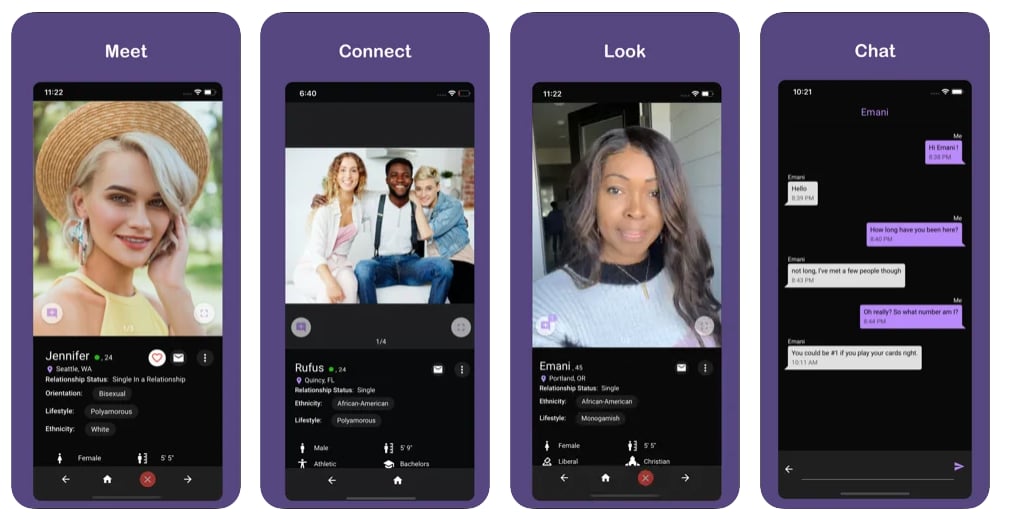

You might have been aware of the buddy Finder variety of internet dating sites prior to. The most popular website inside their operation will be the extremely preferred Sex buddy Finder, which will be one of the more reputable and most hectic online dating sites programs on the market.

But these days we are taking a look at among the aunt websites of Mature Friend Finder â

FriendFinder-X

.

While mature Friend Finder provides much more to the people wanting love, FriendFinder-X is focused on the casual dating and hookups.

But with so many hookup web sites on world, so how exactly does FriendFinder-X easily fit into? Is there someplace for it amongst the Tinders therefore the OKCupids?

We have now dug deep into this hookup website to offer the lowdown. Listed here is our detail by detail FriendFinder-X analysis.

Initially Impressions

FriendFinder-X looks awful. I hate to get thus blunt, nevertheless the site looks like anything created by a 12-year-old. The logo is blurry, along with plan may be the traditional orange and bluish; the same program used by plenty frustrating popup adverts for your own attention. Generally, it appears like shit.

Below that, situations do not get a lot better. You are revealed a number of site “members” who will be clearly maybe not genuine members, because they’re all famous lovely women from the net. Then there is a banner announcing:

“The Whole World’s Largest Casual Personals Site.”

Your website information in the bottom reads:

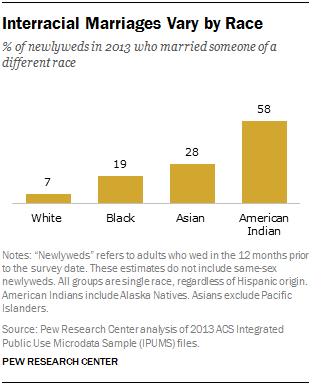

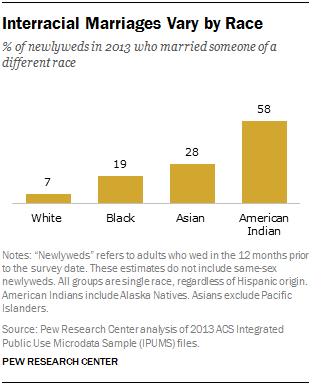

“enjoy sex dating, fulfill swingers, find local sex towards you about greatest on-line adult dating website online. Regardless if you are trying to hookups, everyday dating, hitched internet dating with an Asian, White, dark, Latino, interracial singles or lovers for sex, FriendFinder-X may be the sex dating site for your family.”

Okay, very about they are clear using their purposes. This might be somewhere locate a sexual lover, maybe not a relationship, and that’s fine. I can just expect the website lives as much as their guarantees.

The signup process is at the top the screen. It prompts you to definitely input the basic details; man, lady or couple and whether you’re looking for another man, lady or pair. Then you definitely’re taken inside main FriendFinder-X web page.

That is where circumstances have fascinating. Over the left hand part, you’re shown a sample with the “250,000 member films” your website has to offer. These films are incredibly intimate in nature, featuring half-naked women displaying their unique things. I happened to ben’t worrying, but I’d my worries why these attractive girls required a dating website to get put.

From here you’ll be able to carry on the enrollment process. You’ll want to place in your location, email address, username and password to generate your account. At this time, you will end up a no cost user and you’ll be shown your “new suits” along the region of the screen. While these ladies are called “matches,” they are really and truly just people who find themselves in your area.

Okay, so thatis the basic setup. With this point, it is a point of creating the profile and interacting with a few of the users. Much more about that next section.

Yeah, FriendFinder-X did not make a very first perception beside me. From the bad style on the obviously-stolen sex videos, it seemed like another porn-site-disguised-as-hookup-site to lure in unsuspecting customers and steal their money. Maybe not fantastic. But carry out acts enhance from this point?

Totally Free Characteristics

Profile production is relatively easy. Any profile needs at least two pictures (and videos, if you want) before they can be considered by others. Inside profile, you are asked to fill in the basic info like age, area, sexual orientation, marital standing and body kind, and then you can create slightly about your self during the bio section. Additionally a section to fill out your own desired kinks and fetishes.

As a free member, I got limited functionality on the site, but I tried to stretch it as far as I could. Some tips about what i discovered you could carry out as a totally free user:

1st and most important thing in my experience is if I’m able to look at profiles. Its best that you get an example on the user base before investing in a membership. And thankfully, you are free to scan any profile entirely as a free of charge user. You can see their bios, images, videos and whatever else they may have on the profile. This might be a massive, potentially game-changing bonus free of charge people.

If you are looking at these pages, you are liberated to “like” your chosen images and movies. Each other get a notification you have enjoyed their material, making it a gateway to a prospective talk. You’ll be able to like add your favorite users to your Hotlist to help you look at their unique profile whenever you fancy.

FriendFinder-X appears to be huge on society heart. They’ve a number of boards readily available, all of these deal in x-rated motifs and subjects. Like, you can find chat rooms for SADOMASOCHISM, polyamory interactions, moving and a lot of some other kinks. Free members can search and chat throughout these rooms as much as they really want.

There is such a thing as VIP members, but try not to get these mistaken for regular settled users. VIP members have actually settled added for ability to end up being contacted by free of charge people. So, as a free user, you

can

message these people. Truly the only disadvantage is many VIP users tend to be dudes.

The past in the no-cost attributes concludes with member web cams. From time to time, the more outgoing members of the site will transmit by themselves for all to watch. Some women demand with this although some you shouldn’t. Complimentary members can view one live product daily, supplying the design actually billing for entryway into her area.

Paid Features

To see other attributes you’ll need to update toward paid account, and/or silver account since it’s recognized. That’s what I did. Immediately, a lot of other, far more useful functions jumped upwards.

The initial was the ability to send messages. FriendFinder-X’s talk element is not any dissimilar to some other online dating site. Once you secure on an individual you want, smack the “send a message” switch and you will be on the way.

In terms of user base, there is apparently a good amount of task on right here. Some evaluations have planned FriendFinder-X to be rather slow with respect to footfall, but i came across to be reasonably active. New users renewed on the homepage each hour and that I hardly ever went into the exact same individual twice.

Based on the web site’s numbers, you can find 90 million users on the site, with just a 3rd ones becoming inactive. The majority of people have been in the United States, but FriendFinder-X has a good presence in Canada, the UK, Germany alongside areas of american European countries.

There is matching system on FriendFinder-X, basically a little bit of a downer. People aren’t coordinated centered on personality or appeal. Actually, they aren’t coordinated at all. The only thing you should have in accordance with all the folks you accommodate with is you live near one another.

It is lucky, subsequently, that FriendFinder-X provides a good advanced level search function. Should you want to fulfill your own perfect individual, can be done that by indicating your hunt choices immediately after which slowly narrowing down your pursuit effects. Lookup filters feature sex, intimate orientation, area, profile completeness, and even breast dimensions.

If regular communications you should not do so for your family, absolutely a video clip talk selection for more outbound people. Movie chatting is a great to strategy to bond with some one and add that individual touch towards relationships. It is also a pretty good way to confirm your individual on the reverse side of the display is genuine and that you’re perhaps not talking to a machine.

In continuing utilizing the community-building services, absolutely a section for customers to share sensual stories. A number of these are derived from real experiences with the people, so they’re very hot. If literary works gets you heading, you’re going to be in paradise right here.

Paid people can view as much alive design webcams as they like. Some alive versions cost an added cost for space entry, and design chats are merely offered by buying tokens at another cost as well. These expenses rely on the musician at issue.

“Sex Academy” is just one of the a lot more unique characteristics, and another basically utilized by all buddy Finder internet sites. The Sex Academy is largely a series of courses it is possible to take which educate you on the ability of sex. Should it be about intimate techniques or particular kinks, you can get a certification within chosen intimate area. When you go a course, you get some badge on the profile stating therefore.

Hot Or Otherwise Not. Weekly, FriendFinder-X provides photo tournaments where you are able to vote on the hottest men and women on the webpage. When you scroll through profiles on Hot or perhaps not page, you’ll be able to offer a thumbs up or a thumbs down. People that have one particular thumbs-up get featured regarding the primary page. All ballots published are totally anonymous.

Pricing & Membership Details

FriendFinder-X provides a handful of membership solutions. There’s the conventional totally free Membership, next absolutely the Gold Membership, then there’s something called the traditional connections Add On.

Firstly, some tips about what you get with the

Free Membership

:

-

Join

-

Make your profile

-

Enroll in sites & teams

-

Join boards

-

See, like, and comment on contest pictures

-

Forward likes to images and films

-

See real time member web cams

As a free user you may get a taste for website and find out if it’s the type of program you might delight in. Whilst you can’t really talk to people, it’s still feasible attain a feel on the potential hookup associates you might meet on right here.

Here are the characteristics you may enjoy with a

Gold Membership

:

-

Forward flirts

-

Forward friend needs

-

Read and send emails

-

Comment on photos & videos

-

See full-length movies

-

See full size photos

-

View programs in Sex Academy

-

Use of adult flicks & live types

-

Group chat capabilities

-

Consideration customer support

Gold Membership costs:

-

1 month â $20 per month

-

3 months â $20 per month ($60 total)

-

one year â $15 monthly ($180 complete)

As a gold member, you can enjoy most of the solutions being offered without restriction. The actual only real things that will need more repayment include alive activity web cams. Repayment for those are offered in the forms of tokens, and every specific sexcam session will surely cost yet another many tokens depending on the musician.

Lastly, absolutely the typical Connections Add-On. This enables cost-free people to look at the profile and message you without the need for these to update to a paid membership. Your profile are going to be highlighted for the VIP part to their major screen.

Positives

Despite a rugged begin, I found that FriendFinder-X had countless advantages choosing it.

Registration can be as easy as inputting your name, age and email address. Profile verification is actually a pleasant small touch too. It certainly is advisable that you begin to see the web site developers set steps directly into weed out the fakes.

Many people, a lot of activity. I did not count on such a busy user base, nevertheless seems that FriendFinder-X were not sleeping whenever they mentioned they have around 100,000 effective consumers at any one time. Although the “90 million subscribed people” seems a little bit of a stretch, there’s really no doubt FriendFinder-X is actually an active intersection in the net.

Giving and receiving emails is just as fluid as any dating website i have utilized. There are not any pests, no perform communications (hello lots of seafood) and you aren’t getting inundated with messages from spam users selling you junk.

One small function that pleases myself is the fact that once you see pages, it tells you when that individual ended up being last on line. Therefore, whether it claims these people were last online 36 months before, you are sure that there’s really no point messaging them.

Browse choices are excellent. It is possible to restrict by the necessary criteria including age, area, figure, sex and sexual tastes.

And while we are discussing search choices, there’s a part to look by kinks and fetishes as well. This makes it actual easy to find that great SADOMASOCHISM lover or that chick which’ll love the opportunity to engage the PVC fetish.

The alive motion webcams may be lots of fun, particularly because majority of are usually real people in FriendFinder-X as well. That girl whoever profile you have been spying on? Linger around and also you might see the girl baring by herself on sexcam. To manufacture things much easier, you may also join sexcam sessions as an anonymous user.

Movie chats are a lot of enjoyable. Not simply will they be just the thing for weeding out of the artificial profiles, even so they’re good for building rapport very rapid. She is probably fed up with getting endless created communications, so you can supply her something different with a video chat.

The typical user age on FriendFinder-X is actually 25. It really is just as popular with the students crowd because it’s aided by the thirty-somethings. Then chances are you’re somewhere inside this demographic yourself, so you’ll have no issue locating age-appropriate customers for yourself.

The expense of a silver Membership is damn great, specially given that many matchmaking platforms stay the $40 level for starters month. FriendFinder-X is considerably cheaper therefore it won’t put your charge card under much tension.

The regular Contacts increase is quite of good use and provides you a lower body through to your competitors. When free users are hesistant to invest in a settled membership, chances are high they are going to hit upwards many VIP customers for a taste for the website, you may be usually the one they contact. This throws you at a great advantage. Some evaluations dislike this little feature because it feels unfair, but I say all is fair in sex and combat.

The boards are a variety of enjoyable, and they’re a terrific way to fulfill men and women away from drive texting. Sometimes, the very best relationships are designed when you are maybe not wanting it. Since chat rooms are catered to sexual passions, its genuine easy to find some body you click with on a sexual amount.

Most product reviews believe the gender Academy is silly (and that I can see where they’re from) but I really like it. It really is a funny small method of building a community and it also creates a fascinating chatting point when chatting new people (individuals who’ve graduated a Sex Academy training course get a little badge on the profile saying so).

Cons

The deficiency of any type of coordinating program kinda sucks. There are no character quizzes available or everything that way, generally there’s really no requirements discover fits. You are simply provided a huge range of those who inhabit your area.

Despite every profile requiring a profile photo as recognized onto the web site, i discovered several anonymous profiles. They certainly were the folks which used photographs which did not integrate confronts in them. I don’t know why they may be using a hookup site if they’re not ready to show the entire world whatever they appear to be.

Even though the site is actually improved for cellular web browser use, there is cellular app for FriendFinder-X. This is simply not perfect, and it’s really just a little unusual since the buddy Finder system is completely huge. All of their other solutions have actually committed programs, but FriendFinder-X appears to have been kept at nighttime.

Yourself, the amount of mature video clip content material on the site was actually some a lot. I don’t see the point of luring in members with all the promises of pornography. It is not like you will findn’t already a million pornography internet sites available at the click of a button.

Bottom Line

I actually expanded to essentially enjoy FriendFinder-X the more I tried it. While I at first hated it, I really found it are a really pleasant knowledge under the rough area.

Will it be a online dating service around nowadays? No. Maybe not by a lengthy try, but that doesn’t mean it is completely worthless. It’s some very nice attributes, outstanding neighborhood, and can produce set should you decide place the hrs in.

On the whole, i am providing FriendFinder-X a good 3/5 stars.

Develop you liked our FriendFinder-X overview. When this website doesn’t tick the boxes, available our different evaluations

right here

.

Prepared decide to try FriendFinder-X?

FAQs

Is actually FriendFinder-X legitimate?

Yes, FriendFinder-X is a legitimate dating internet site with around 90 million registered users globally. The site provides about 100,000 energetic consumers every day. Additionally, it is one of the oldest online dating services on the web, having been around for practically 2 decades.

Really does FriendFinder-X have an app?

No, there is no FriendFinder-X mobile app. But the web site is improved for usage on mobile web browser.

Exactly how much does FriendFinder-X cost?

For a FriendFinder-X settled membership, it will cost between $15 and $25 each month according to your degree of dedication. While there’s a free membership alternative available, web site functions are restricted.

Is actually FriendFinder-X different from AdultFriendFinder?

Yes, FriendFinder-X and AdultFriendFinder are two different adult dating sites which serve different audiences. FriendFinder-X is actually somewhere to obtain informal gender and {